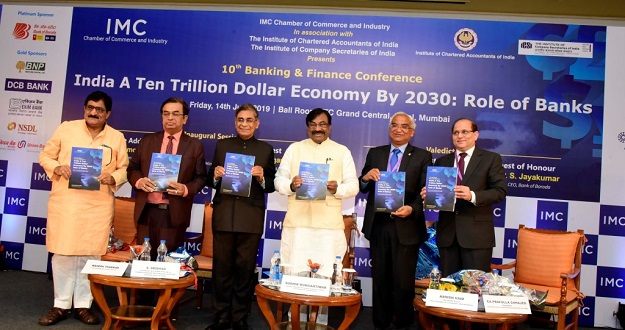

10th Banking & Finance Conference

"India a Ten Trillion Dollar Economy by 2030 : Role of Banks"

On Friday, June 14, 2019 from 09.30 a.m. to 5.30 p.m.

Venue: ITC Grand Central, Parel, Mumbai

BUSINESS SESSIONS

- Session - I: Project Finance : Gearing Up for Challenges

- Session - II: Cyber Security in Banks

- Session - III: Inclusive Banking : Way Forward

- Session - IV: Stressed Assets: Future Outlook