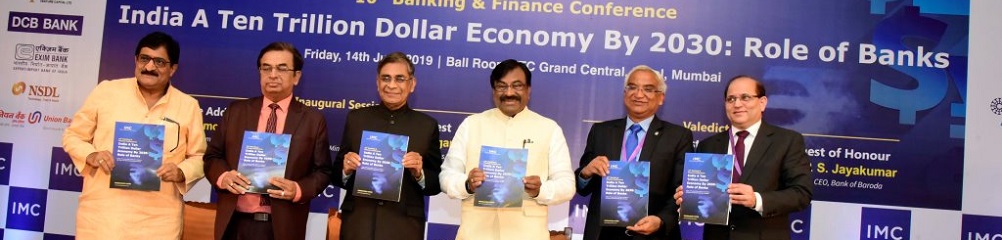

10th Banking & Finance Conference

‘"India a Ten Trillion Dollar Economy by 2030 : Role of Banks"’

On Friday, June 14, 2019 from 09.30 a.m. to 5.30 p.m.

Venue: ITC Grand Central, Parel, Mumbai

press release 2019

press release 2017

press release 2016

-

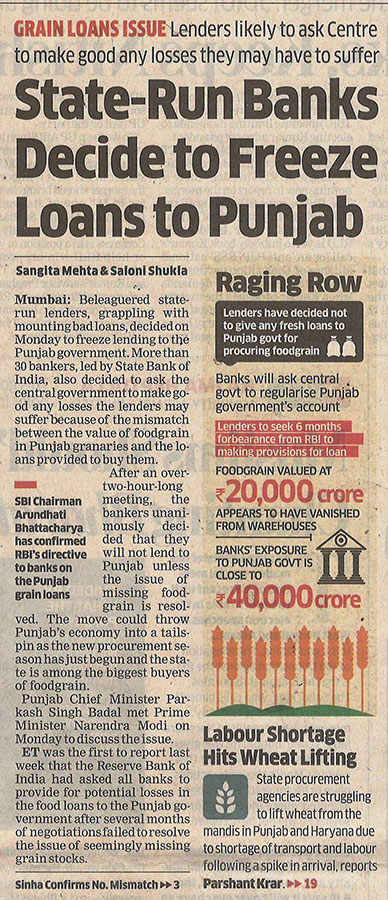

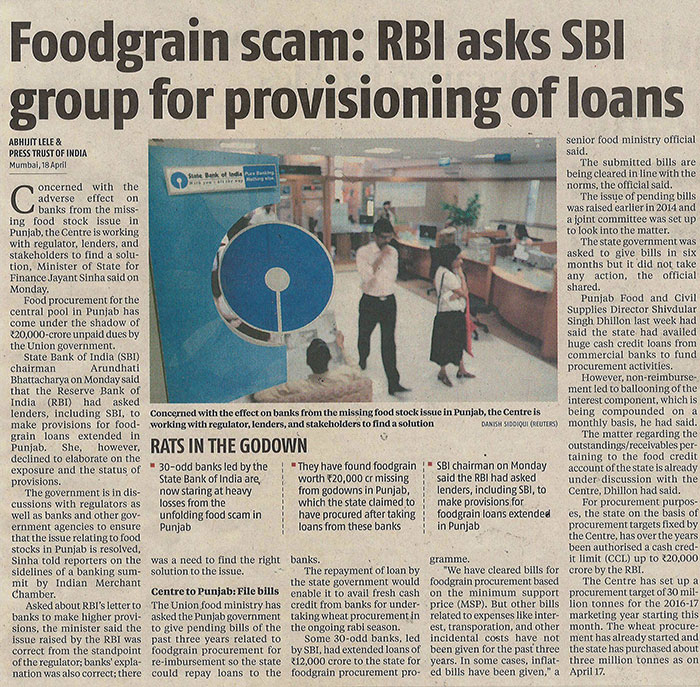

8th Banking & Finance Conference on Changing Contours of Banking and India’s Growth Aspirations - April 18, 2016

8th Banking & Finance Conference on Changing Contours of Banking and India’s Growth Aspirations

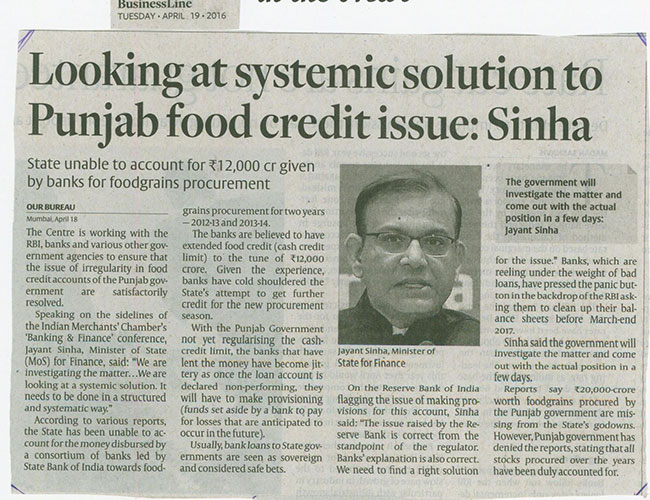

Addressing the 8th Banking and Finance conference, Mr. Jayant Sinha, Hon’ble Union Minister of State for Finance and Chief Guest said that the key objectives of the government are the need for financial inclusion, the efficient allocation of capital and thinking about the future. The manner in which the financial sector is currently structured is creating tension and thisneeds to be resolved at the earliest. His government has increased the number of new entrants into the sector (23 new banking licenses issued) and has also raised FDI in insurance to 49%. In terms of technological changes, he highlighted particularly on the unified payment interface, which is making possible the digital transfer of money. There is in place the development of a range of products tailored to the base of the pyramid.

The Indian Merchants’ Chamber (IMC), in association with the Institute of Chartered Accountants of India (ICAI),had organisedthis Conference on Monday, April 18, 2016. The theme of the Conference was “Changing Contours of Banking and India’s Growth Aspirations”.

Mr. Sinha further stated that the government has to play the regulator’s role by understanding policy gaps and trying to close them. He also informed that his government is also working closely with the RBI and other stakeholders to understand where the stress in the system lies and is trying to alleviate it. His government has restructured policies to change the appointment system to top positions in PSUs. They are working hard with banks to build up talent and capabilities. The development of risk management and surveillance mechanisms are top priorities for them.

Indian banks need sufficient scale to become globally competitive. The government is making concrete efforts in this area. As the government continues to work on policies, the issues confronted when they took charge in 2014 are now rapidly being closed.

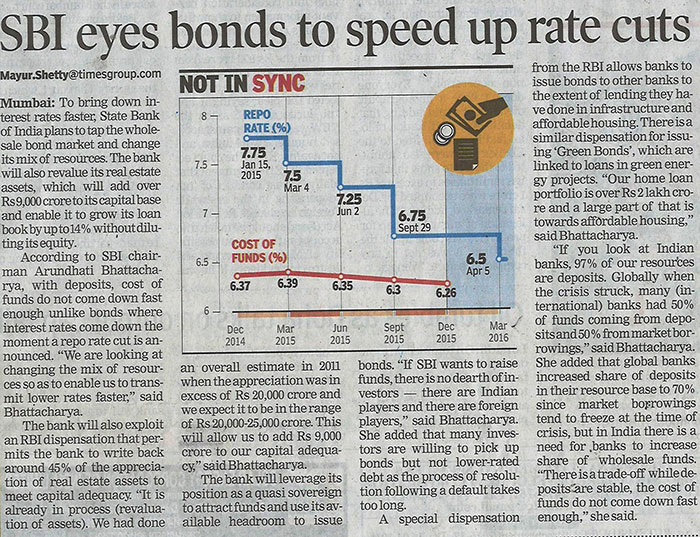

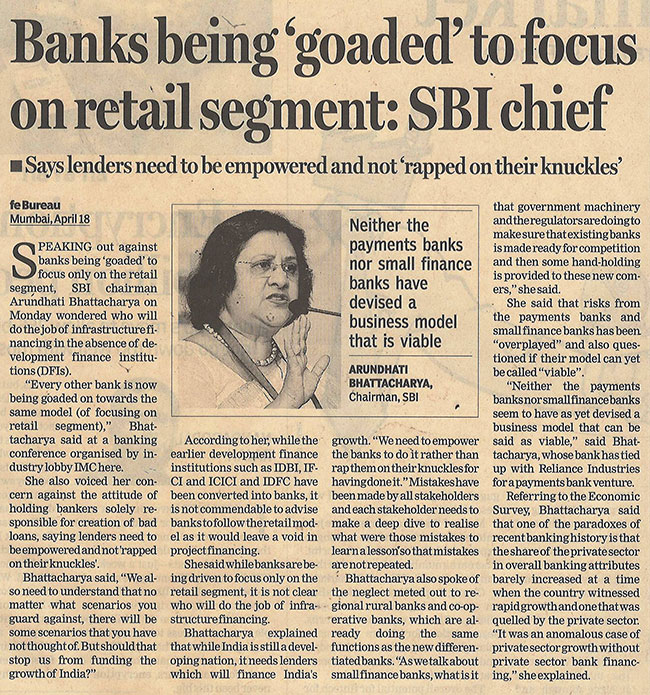

Mrs. Arundhati Bhattacharya, Chairman, State Bank of India was the Guest of Honour at the inaugural session.She opined that there is a sharp rise in NPAs in banks’ due to which the sector is going through a period of stress. Two successive droughts have exacerbated the situation. Some questions asked in the early 1990s are now being asked again. The performance of public sector banks has deteriorated in the past, but of late it has converged with that of the private sector banks. In the long run the CAGR of both public and private sector banks is almost identical. Further more, she reiterated that competition and technology are interacting with each other as never seen before. Mobile banking is leading to a revolution and it is going to particularly benefit the youth and techno savvy sections of society. The biggest gain from technology adoption by banks is that it helps attract and retain younger and more affluent customers.

Mrs. Bhattacharya further spoke about the changes that need to be meted especially on the narrative in the media. She quoted “Mistakes have been made by all stakeholders and we need to find and fix them.Banking remains one of the most regulated sectors in the world. However, the challenges ahead of us will end up strengthening the sector”.

Mr. Dilip Piramal, IMC President said “Technology is changing the banking landscape and it is heartening to see a strong commitment of the government to interact with business leaders. The development of risk-management techniques are becoming increasingly necessary to deal with an increasingly uncertain financial landscape. Digital banking and financial inclusion go hand in hand, and the adoption of technology will help resolve many issues facing the sector. However, resolving the NPA issue should be a top priority for all stakeholders. He congratulated Mr. Chandan Bhattacharya and his team for putting together a very successful event.

About Indian Merchants’ Chamber

Set up in 1907, Indian Merchants’ Chamber is an apex Chamber of trade, commerce & industry with headquarters in Mumbai. It has about 2700 direct members, comprising a cross section of the business community, including public and private limited companies and over 225 trade and industry associations through which the Chamber reaches out to over 2,50,000 business establishments in the country. IMC is the first Chamber in India to get ISO 9002-2000 certification which has since been upgraded to ISO 9001: 2008. IMC is the only business Chamber in India with which the Father of the Nation, Mahatma Gandhi, was associated as an Honorary Member.

PRESS RELEASE 2015

-

SEEK MORE, GAIN MORE – BANKING HEADS AT IMC’S NATIONAL SEMINAR URGE BANKS TO BEEF UP THEIR RISK-MANAGEMENT SYSTEMS AND SMES TO AVAIL INNOVATIVE FUNDING PRODUCTS - MAY 8, 2014

SEEK MORE, GAIN MORE – BANKING HEADS AT IMC’S NATIONAL SEMINAR URGE BANKS TO BEEF UP THEIR RISK-MANAGEMENT SYSTEMS AND SMES TO AVAIL INNOVATIVE FUNDING PRODUCTS

Seminar also addressed by Mr R Gandhi, Deputy Governor of the Reserve Bank of India

Mumbai, May 8, 2014: The Indian Merchants’ Chamber on Thursday upheld its tradition of provoking thoughtful dialogue on critical financial issues at its National Banking Seminar in a South Mumbai hotel. The second half of its day-long event, titled ‘Indian Banking at the Crossroads – Challenge of Risk Management – from Globalisation to Financial Inclusion’, witnessed the RBI Deputy Governor, top heads of financial institutions as well as a Rajya Sabha MP share the dais.

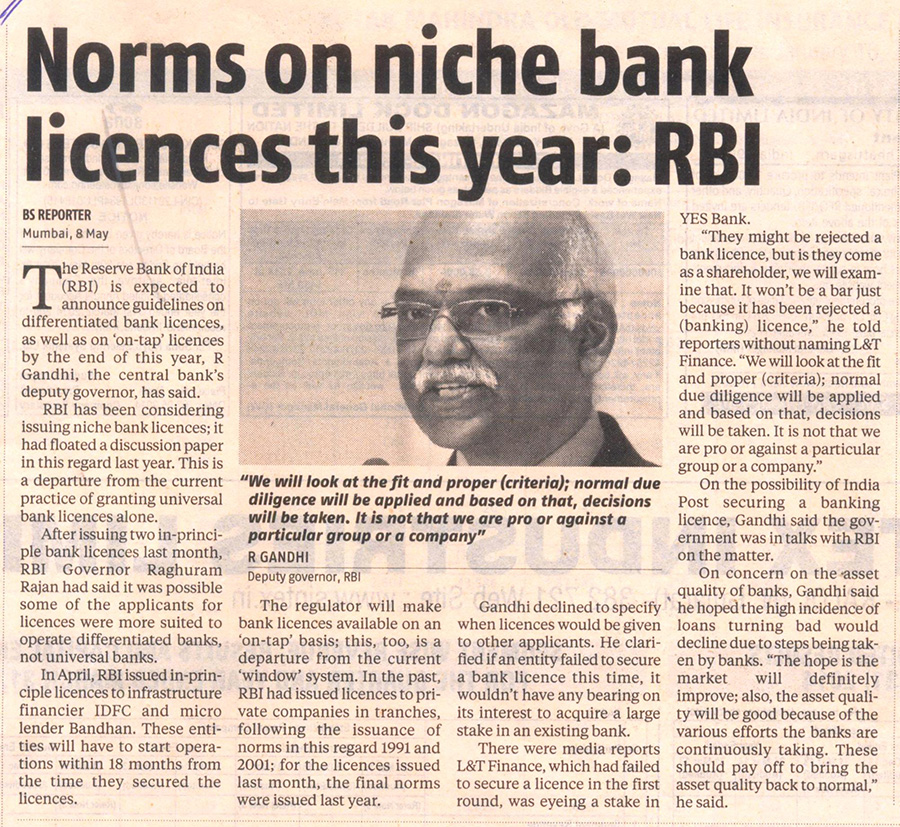

Chief Guest of the Valedictory Session, Mr R Gandhi, Deputy Governor of the Reserve Bank of India provided the valuable perspective of the country’s banking regulatoron the issue of risk management. Detailing the risk culture in India and the banks’ attitudes toward them, Mr Gandhi assured the audience that RBI had adopted a proactive approach towards banks pertaining to risk management. “Risk management is a now a highly complex and sophisticated discipline. We want to empower the Chief Risk Officers of banks to bring about cultural changes in their organisation. We have also taken measures to reduce interconnectedness among banks,” he said.

Evoking and fleshing out the top provisions of Basel III, the global regulatory standard for banks, Mr Gandhi urged banking institutions to follow them and achieve a wholesome success. “The Basel III has a global framework for banks to manage risks. It has several paradigm-changing approaches and guidelines for banks,” he explained. Furthermore, he pointed out various ways in which banks could achieve a harmonious risk culture: “The risk appetite and tolerance levels of financial institutions must be clearly defined. An independent risk management function headed by a Chief Risk Officer is critical, and that should include auditors too. Stress testing and back-testing must be gainfully utilised and most importantly, there should be a robust technology platform to support this framework,” he said, addressing the dignitaries and media.

Prior to this, the seminar was marked by an exciting session on ‘Innovative Strategies for Funding for SMEs.’ Chaired by Mr RK Dubey, Chairman & MD of Canara Bank, the session proposedinnovativeways in which small and medium entrepreneurs are procuring funds from banks. “SMEs must avail of the opportunity of listing themselves on the BSE to gain widespread recognition and seek more capital assistance,” Mr Dubey suggested, adding, “Cluster-based funding is another innovative strategy. We have 388 area-wise clusters of businesses all over India and have customised our schemes locally, just as the NBFCs.”

Rajiv Sabharwal, Exec Director, Retail Banking, Inclusive & Rural Banking and SME and mid-corporate, ICICI Bank, pointed out: “Banks are finding ways to find the true incomes of SMEs. We scan and study bank statements of applicants and then suggest them products. That said, we are always thinking of more innovative ways, nobody wants to let credit go away!” He also predicted that banks will decide on lending money to SMEs in shorter times. “Just like home loans, which are processed in four-five days now, I’m sure that time will be soon reduced to 24 hours!” Mr UG Revankar, MD, Shriram Transport Finance also offered his thoughts on the subject.

Reflecting on an engaging day of discussions and interactions, Mr Shailesh Vaidya, IMC President said, “The challenges of risk management weren't always recognised effectively. I am sure the deliberations at our seminar have helped the cause of India’s finance and banking system. Today’s inputs by such a formidable panel and eminent speakers will to some measure surely contribute toward a stronger banking eco-system.”

-

Top bankers discuss the global challenges and better risk management at IMC’s seminar - MAY 8, 2014

Top bankers discuss the global challenges and better risk management at IMC’s seminar

Mumbai, May 8, 2014: It was yet another day of knowledge sharing in the calendar of the Indian Merchants’ Chamber (IMC) as it hosted a national seminar on Indian banking at a South Mumbai hotel. Attended by Chairmen and Managing Directors of India’s top banks, banking professionals, accountants and a host of delegates, the seminar titled ‘Indian Banking at the Crossroads - Challenge of risk management - from globalisation to financial inclusion’ laid bare the challenges to Indian banks in today’s globalised scenario.

Shailesh Vaidya, President, IMC expressed much gratification at the way the seminar stayed focussed. “Risk management and financial inclusion are complex challenges for our banks in today’s globalised scenario. I’m glad we were able to put together a distinguished panel of speakers. I’m sure this seminar would offer its attendees an informed perspective and a sharper view.”

Split into four sessions, the seminar kick-started on an honest note with an address by Chairman of the Finance & Banking Committee, IMC, and former MD of SBI, Mr Chandan Bhattacharya. “Risks of banks today are like a rainbow –multi-layered and unique. But they’re also connected with the global scenario and the aspirations of the common man. Banks must make advances to bring in sophisticated tools to manage risks. And they must do this while expanding at a rapid speed too, so our vast population avails banking services.”

That said, the headliner of the day was clearly the Chief Guest, Ms Arundhati Bhattacharya, Chairperson of the State Bank of India, the first lady to occupy the designation in the history of India’s largest commercial bank. In her multi-point speech, she delved into the complex nature of challenges in financial inclusion, such as migrants in urban areas not having documents to open bank accounts. While putting into perspective that it is in the inherent nature of banks to take risks, she highlighted the importance of pricing risks and the dangers of under-pricing them.

“The two most important risks banks are facing today are interest rate risk and exchange rate risk. And as they affect other risks too, banks will have to revamp their assessment of credit risk at portfolio levels and the expected losses on account of credit risk will also rise,” Bhattacharya suggested, signing off that risk management will only get more complex in a globalised world.

The seminar saw another distinguished lady on the dias, Ms Usha Ananthasubramanian, Chairman & MD of the Bhartiya Mahila Bank Ltd, a one-of-a-kind institution in India. ‘Financial illiteracy’, i.e. inability of customers to understand the banking process, to her mind is an issue that Indian banks face not only in rural areas but in metros too. “Today I know so many urban women, even HNIs, who can't make their own financial decisions, depending upon their husbands or friends. Financial literacy is the key to financial inclusion.”

The second session on Financial Reporting & Risk Management saw CA. Charanjot Singh Nanda (Central Council Member of the ICAI) and CA. Jatin Lodaya discusses financial reporting as a support to risk management. “Every bank has a different risk appetite. But if it’s financial reporting is in good shape, its managers will be able to manage risks better. Elements such as IFRS, ADF and ICAAP are the success mantras to better risk management,” Lodaya offered.

-

India’s GDP growth to be among world’s highest despite the impact of Euro Zone crisis, says Mr. Pranab Mukherjee - 7 April, 2012

India’s GDP growth to be among world’s highest despite the impact of Euro Zone crisis, says Mr. Pranab Mukherjee

Mumbai, 7 April, 2012: In spite of the persisting economic crisis in many of the developed Western countries since 2008, India’s GDP growth this year is likely to be more than 6.9%, one of the highest in the world, says Mr. Pranab Mukherjee, Union Finance Minister. Mr. Mukherjee was delivering the inaugural address at the Indian Merchants Chamber organized 6th International Banking and Finance Conference 2012, in Mumbai on April 7.

Some of the other dignitaries who addressed the conference were: Mr Rajkumar Dhoot, Member of Rajya Sabha & President of Assocham, Mr. Pratip Chaudhuri, Chairman, SBI, Dr Subir Gokarn, Deputy Governor, RBI, Mr. Anand Sinha, Deputy Governor, RBI, Mr. M D Mallya, CMD, Bank of Baroda and Chairman of IBA, and CEOs and decision-makers of leading banks and financial institutions.

Speaking at this grand conference, Ms Bhavna Doshi, IMC President, said, "This conference aims at creating awareness of current day trends in the finance & banking industry. And for that purpose, it provides a forum for interaction between eminent bankers, finance professionals, policy makers, opinion leaders, regulators and other stakeholders in the banking and finance sector."

The technical sessions included some vocal brainstorming about some of the key issues in today’s economic scenario - * Role of the financial sector in achieving sustainable growth for India, * Financial Statements -- Transparency & Disclosures, * Enablers for the financial sector's growth -- technology & reforms, and * Impact of global turmoil on Indian economy.

The Finance Minister said he would not risk a guess as to when would the global economic crisis end. He had a discussion with his counterpart in UK aimed at containing the financial contagion in four countries of the Euro Zone from spreading.

Sharing his thoughts on the growth of India’s economy, he said, “In the light of the strong cross-border economic linkages, global crisis held out a threat to the growth of emerging countries. Consequently, India’s growth rate declined to 6.6% in 2008-09 from the high level of 9% plus registered by it consistently between 2005 and 2008.”

He also mentioned some other factors like widening fiscal deficit and rising inflation also contributing to the setback to India’s GDP growth. “Now, we are firmly on the way to economic recovery. Our economic growth is likely to rise to 6.9% this year from the last years’ 6.6%. Also our fiscal deficit is likely to narrow down to 5.1% of GDP from last year’s 5.9%,” he said.

He observed that India was able to withstand the harmful impact of global economic crisis with considerable success. “Very few countries in the world can boast of a growth rate higher than 6% and India’s growth rate has been among the highest in the world”, he added.

Mr. Mukherjee made no secret of his admiration towards the Indian bankers “who adopted a prudent policy, and did not run after toxic assets, like the bankers in Western countries.” He emphasized that bankers should never ignore the prudential norms “pertaining to banking such as transparency, risk management, governance, deposit-guarantee etc. Financial stability must be integral part of our national policy.”

Another important point captured by the Minister was that banks’ capital adequacy should remain strong and above the Basel III regulatory requirements. For ensuring the sound health of banks, the Indian Government had infused Rs. 10,000 crore in 2010-11, and a similarly large amount in 2011-12,” he asserted.

Referring to the need of ensuring “inclusive growth”, he said the government had launched two schemes, Swabhiman and Swavalamban.

‘Our Budget target to set up bank branches in 73,000 villages, with a population of upto 2000 each has already been implemented. I am extending the plan now to include all villages upto a population of 1,000 each in North-Eastern states,” he announced.

Mr. Niranjan Hiranandani, President-Elect, IMC assured the Minister of IMC’s full support to all its programmes such as NREGA, Right to Education, Right to Food security and to ultra-small banks to be set up in North-Eastern region.

Earlier, addressing a technical session, Dr. Subir Gokarn, Deputy Governor of RBI, said that the Government’s plan to set up bank branches even in small villages was indeed laudable. “But, It is equally important to ponder whether people are making good use of low cost credit extended to them? Bank personnel have a great responsibility for ensuring that the funds are put to good use. Also, they need to ensure that cost of last-mile credit delivery remains low,” he said.

Mr. Rajkumar Dhoot said that the Indian financial services sector had successfully withstood the global financial crisis with great resilience. But the industry was still required to serve as the growth engine for transforming our country into a modern economy and for achieving a sustainable double digit growth through expansion of its financial services.

"Despite the financial sector's rapid growth, the fact remains that only 13 per cent of India’s total of 6,00,000 villages have branches of commercial banks, and only 40 per cent of India's total population have bank accounts. Considering these facts, the financial and banking sector can play a pivotal role in bridging the gap between the urban and rural India, and ensuring a speedy economic growth by tapping the savings of a large section of unbanked population," he said.

For more details, please contact: Vaishali Killawala

Deputy Director- PR, IMC

Tel: 2204 6633, Etn: 113

Mobile: +91 - 9819630256Ashutosh Rai

Sr. Manager, PR, IMC

Tel: 2204 6633, Etn: 118

Mobile: +91 - 8286947024

- SBI to launch children's savings a/c in 3 months

- Top bankers discuss the global challenges

- Indian Banking at Crossroads – Challenge of Risk Management from Globalisation to Financial Inclusion

- Indian Banking at Crossroads – Challenge of Risk Management from Globalisation to Financial Inclusion (Valedictory address delivered by Shri R. Gandhi, Deputy Governor, Reserve Bank of India on the occasion of Seminar on Banking at Hotel Taj President